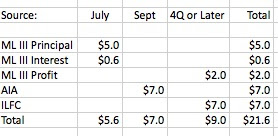

The FRBNY is proving to be a diligent and determined seller of Maiden Lane III assets. Maiden Lane III will soon be able to pay back it's loan from the FRBNY in full. After it pays the principal and interest to the New York Fed, the next approximately $5.6 billion is cash from sales will flow directly to AIG.

At the pace of sales, this could happen closer to July 1, 2012 than the previously estimates discussed in the financial press of the end of the year.

This is important for AIG because Maiden Lane III assets are approximately 14% of AIG's market cap. These sales continue to support the view that their accounting has been conservative, that they are more liquid than thought, and there is potential for modest upward surprises like the current estimate of a $2 billion profit for AIG.

In addition, a full or partial payoff to AIG in the July timeframe could support the Treasury public offering of 400 million shares, with AIG taking 200 million in the next 60 days or so. Another dent in the 'overhang' and another simplification to a description of how the Treasury is making money on this deal and what needs to happen to wrap it up.

Since my prior post, consider the following activity:

1. FRBNY has

announced a successful auction of TRIAXX CDO's. Results of the auction of the CDO's with a face value of $2.5 billion may net as much as $2 billion*.

2. FRBNY

announced on 11 May, 2012 an auction of 2 CDO's (CUSIP 26441EAL5 and 25441EAA9), with a face value of $1.67 billion, with bids due on 17 May, 2012.

3. FRBNY

announced on 11 May, 2012 an auction of 5 CDO's (CUSIP 746860AH9, 746860AK2, 746860AM8, 746860AP1, 746860AR7, and 746860BE5), with a face value of $0.69 billion, with bids due on 22 May, 2012.

The likely cash proceeds from these auctions combined with that of the MAX Commercial Real Estate CDO's is likely to be between $8.5 billion and $9.0 billion.

Maiden Lane III's pro forma balance sheet, assuming a payment of $8.5 billion:

So, the FRBNY principle will be paid off soon. Accrued interest is almost paid off. And future sales will flow directly to AIG until their $5.6 billion

Maiden Lane owns over 100 CDO. A Partial listing including the largest 10 is shown below includes the usual suspects. Davis Square,

Jupiter, etc. :

This includes mezzanine tranches as well as 'high grade' CDO. They can get fair value by selling for less than 33 bp of face value. Given the current market conditions, I expect the FRBNY to just keep selling these unless the market backs up significantly.

And, I don't expect any windfalls, although additional modest gains aren't unlikely.

Sources:

* At year end 2011, the fair value of the TRIAXX was shown at 71% of face value and has presumably improved subsequently.